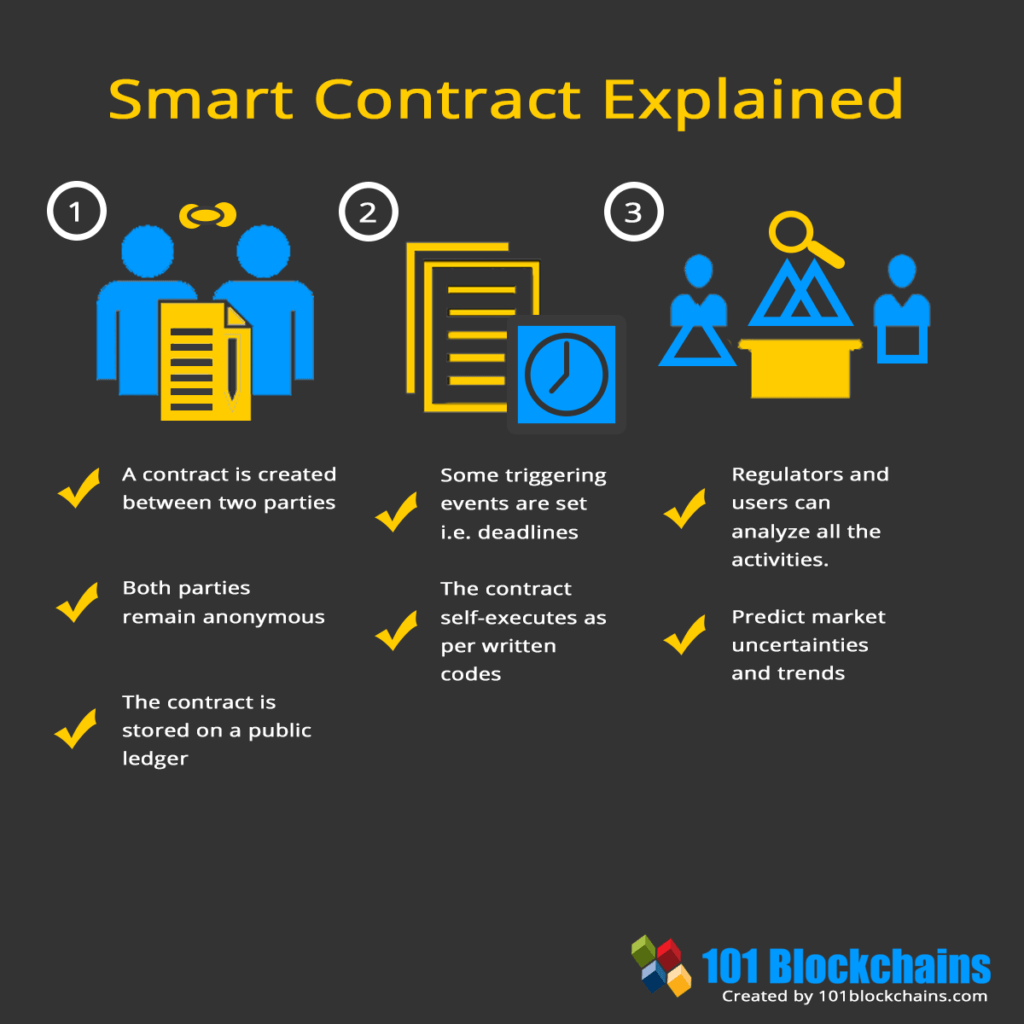

Smart Contracts are swiftly becoming a cornerstone of modern blockchain technology, evolving the way agreements are formed and executed. These self-executing contracts with the terms directly written into code offer a level of automation that traditional contracts simply cannot match. By eliminating the need for intermediaries and enhancing transparency, Smart Contracts are reshaping industries ranging from finance to healthcare.

At their core, Smart Contracts operate on decentralized platforms, executing transactions when predetermined conditions are met. This not only streamlines processes but also reduces the potential for human error. Understanding these fundamentals is crucial for appreciating their increasing significance in various sectors and their potential to disrupt conventional practices.

Understanding the fundamentals of Smart Contracts is essential for grasping their role in blockchain technology.

Smart contracts represent a revolutionary advancement in how agreements are executed and enforced, serving as self-executing contracts with the terms of the agreement directly written into code. Operating on blockchain technology, they ensure that transactions are secure, transparent, and immutable. This shift from traditional contractual frameworks to a digital, automated environment has deep implications for the efficiency and reliability of various processes across industries.

The basic concept of smart contracts lies in their ability to automatically enforce and execute contractual agreements once predefined conditions are met. They function through a series of coded instructions that reside on a blockchain, allowing for automatic execution without the need for intermediaries. For example, in a property sale, a smart contract could transfer ownership to the buyer once the payment is verified, eliminating the need for a notary or escrow service. Smart contracts operate on the principle of trustlessness, wherein parties do not need to trust each other but rather the code and the underlying blockchain. This is pivotal for enhancing security and reducing the risks associated with human error or fraud.

Importance of Automation in Smart Contracts

Automation in smart contracts significantly impacts various industries by streamlining processes and reducing costs. The efficiency gained through automation can be illustrated by examining key sectors that are rapidly adopting this technology.

The following points encapsulate the advantages of automation in smart contracts:

- Elimination of intermediaries, which reduces transaction time and costs.

- Enhanced security through encryption, minimizing the risk of fraud.

- Increased transparency, as all parties can view the contract execution on the blockchain.

- Improved accuracy by minimizing human error in contract execution.

- Faster dispute resolution, as the terms are clear and verifiable on the blockchain.

While traditional contracts often involve lengthy negotiations and reliance on third parties, smart contracts reduce the complexity of these processes. However, they also present certain challenges, such as the immutability of the contract code and potential vulnerabilities in the code itself.

Differences Between Traditional Contracts and Smart Contracts

Smart contracts differ from traditional contracts in several crucial ways, each with its inherent advantages and disadvantages. Understanding these distinctions is vital for recognizing the potential applications of smart contracts.

The following table contrasts the two:

| Aspect | Traditional Contracts | Smart Contracts |

|---|---|---|

| Execution | Manual intervention needed for enforcement. | Automatic execution based on coded conditions. |

| Trust | Requires trust in parties and intermediaries. | Trust is placed in the code and blockchain. |

| Cost | May incur legal fees and intermediary costs. | Lower costs due to reduced need for intermediaries. |

| Flexibility | Can be renegotiated or amended. | Immutable once deployed, unless a new contract is created. |

| Speed | Often slow due to bureaucratic processes. | Instant execution upon condition fulfillment. |

The unique nature of smart contracts offers transformative potential for industries such as finance, real estate, and supply chain management, ultimately leading to more efficient and reliable processes.

The various types of smart contracts and their applications illustrate their versatility in real-world scenarios.

Smart contracts are automated agreements that execute when predetermined conditions are met, and they are revolutionizing how various industries operate. Their unique capabilities allow for seamless transactions without intermediaries, providing enhanced security, transparency, and efficiency. As their adoption continues to grow, understanding the different types of smart contracts and their applications becomes essential to recognizing their value in modern commerce.

Categories of Smart Contracts

Smart contracts can be categorized based on their applications and industries. Here are the primary types of smart contracts in use today:

- Financial Contracts: These include agreements related to loans, insurance, and derivatives. They facilitate quick settlement and reduced risk through automated conditions.

- Legal Agreements: Smart contracts are utilized for various legal frameworks, enabling automated compliance and execution of terms without human intervention.

- Decentralized Applications (DApps): DApps leverage smart contracts to operate on blockchain networks, providing services ranging from gaming to decentralized finance (DeFi).

Industries Leveraging Smart Contracts

The implementation of smart contracts is gaining traction across various sectors. Here are some key industries where they are being effectively utilized:

- Finance: Financial institutions are utilizing smart contracts for transactions, credit scoring, and trade settlements to enhance transparency and reduce fraud.

- Healthcare: Smart contracts are employed to manage patient records, consent management, and insurance claims, ensuring data integrity and privacy.

- Supply Chain Management: Companies are adopting smart contracts to streamline processes like inventory management and shipment tracking, ensuring real-time visibility and accountability.

Comparative Analysis of Use Cases

A comparative analysis reveals the efficiency of smart contracts versus traditional methods. In a financial context, traditional contracts often involve multiple intermediaries that increase transaction times and costs. In contrast, smart contracts automate these processes, eliminating the need for middlemen and resulting in faster settlements.

| Aspect | Traditional Contracts | Smart Contracts |

|---|---|---|

| Transaction Speed | Can take days to process | Instant execution upon condition fulfillment |

| Cost | Higher fees due to intermediaries | Lower costs as they reduce or eliminate intermediaries |

| Transparency | Limited visibility and potential for disputes | Full transparency through blockchain technology |

| Security | More vulnerable to fraud and errors | Highly secure due to cryptographic techniques |

Smart contracts are not just a trend; they represent a fundamental shift in how agreements are made and executed across various sectors.

Security challenges associated with smart contracts must be addressed to ensure their reliability and trustworthiness.

Smart contracts have revolutionized the way transactions are executed by automating processes and ensuring trust through blockchain technology. However, as with any technology, they come with their own set of security challenges that must be meticulously addressed. The integrity and reliability of smart contracts depend significantly on their security posture, along with the mechanisms in place to mitigate vulnerabilities and enhance trustworthiness.

Common vulnerabilities associated with smart contracts primarily arise from coding errors and security breaches. These vulnerabilities can lead to severe financial losses and undermine user confidence in blockchain applications. Some of the most frequently encountered issues include reentrancy attacks, integer overflow and underflow, gas limit and loops, and improper access control. Each of these risks can exploit weaknesses in the smart contract code, resulting in unexpected behavior or unauthorized access. Addressing these vulnerabilities is essential for building reliable and secure smart contracts.

Common vulnerabilities and risks

In the landscape of smart contracts, several vulnerabilities frequently surface, and understanding these risks is crucial for developers. A thorough evaluation of these risks can help in designing more secure smart contracts. The following list highlights the most common vulnerabilities:

- Reentrancy Attacks: This occurs when a malicious contract calls back into the original function before the initial execution is completed, potentially draining funds.

- Integer Overflow and Underflow: When arithmetic operations exceed the storage capacity of the variable type, it can lead to unexpected results or exploitative behavior.

- Gas Limit and Loops: Contracts that require too much gas to execute can fail, leading to denial of service, particularly in loops that are poorly designed.

- Improper Access Control: Inadequate restriction on function access can allow unauthorized users to execute sensitive functions, resulting in potential exploits.

Each of these vulnerabilities can be detrimental, highlighting the necessity for robust security practices throughout the development lifecycle of smart contracts.

Best practices for developing secure smart contracts

Implementing best practices in smart contract development is vital for mitigating risks and ensuring security. Developers should adhere to a set of guidelines that can minimize vulnerabilities and enhance the overall security of the contracts. These practices include:

- Thorough Code Review: Engaging in peer reviews and using automated tools to identify potential vulnerabilities before deployment is essential.

- Utilizing Established Libraries: Leveraging well-audited libraries, such as OpenZeppelin, can significantly reduce the risk of introducing vulnerabilities.

- Design with Security in Mind: Employing security patterns, such as checks-effects-interactions, can help prevent common exploits.

- Limit Complexity: Keeping smart contracts simple makes them easier to audit and reduces the likelihood of errors.

By incorporating these best practices, developers can enhance the reliability and trustworthiness of their smart contracts.

The role of audits and testing in smart contract security

Auditing and testing are critical components in the development of secure smart contracts. These processes help to identify vulnerabilities, ensure compliance with security standards, and verify that the contract behaves as intended. Various tools and frameworks are instrumental in this regard, enabling developers to conduct thorough assessments.

Audits typically involve a systematic review by independent experts who scrutinize the code for potential vulnerabilities. This process may include manual analysis and automated testing using specialized tools. Some common tools used for smart contract auditing and testing include:

- MythX: A security analysis platform that provides static and dynamic analysis tools for detecting vulnerabilities.

- Slither: A static analysis framework that identifies common vulnerabilities and potential security issues within Ethereum smart contracts.

- Truffle: A development environment that facilitates testing and deployment, including tools for writing and executing tests against smart contracts.

Through rigorous testing and comprehensive audits, developers can bolster the security of their smart contracts, ensuring that they function reliably and maintain user trust.

The impact of smart contracts on the legal landscape is transforming how agreements are formed and executed.

The emergence of smart contracts has started to revolutionize the legal landscape, fundamentally altering how agreements are structured and enforced. These digital contracts, executed on blockchain technology, eliminate the need for intermediaries, thereby streamlining the execution of agreements. However, this innovative approach introduces a range of legal implications that cannot be overlooked.

The legal implications of smart contracts revolve around issues such as enforceability and jurisdiction. Smart contracts operate automatically when certain conditions are met, which raises questions about how they fit into existing legal frameworks. Traditional contracts are bound by jurisdictional laws and rely on the principle of mutual consent, while smart contracts can cross borders without adhering to specific legal systems. This can create uncertainty in terms of which jurisdiction’s laws apply, potentially complicating enforcement in case of disputes.

Additionally, there are concerns regarding the interpretation of contract language coded into smart contracts. Legal experts may find it challenging to resolve ambiguities present in the code, which could lead to differing interpretations among parties involved. Moreover, if a smart contract fails to execute as intended due to a coding error or unforeseen circumstances, the legal recourse available to aggrieved parties may be limited compared to traditional contracts.

Potential disputes and resolution methods

Disputes arising from smart contract execution can stem from various areas, including code errors, unmet conditions, or parties disputing their obligations. Understanding these potential issues is crucial for effective resolution.

– Code errors: A common source of conflict arises when the smart contract’s code does not function as intended. For example, if the code fails to properly execute a payment, the affected party may seek to pursue remedies under traditional contract law.

– Ambiguous terms: Disagreements may emerge over vague or misleading terms coded into the contract. In such cases, parties may turn to arbitration or mediation as a means to resolve their differences.

– Jurisdictional conflicts: When parties are located in different legal jurisdictions, disputes may arise regarding which court has authority. This can complicate enforcement, as different jurisdictions may have varying interpretations of smart contract validity.

To mitigate these disputes, collaboration between legal professionals and technologists is becoming increasingly important. Legal experts are beginning to work alongside software developers to ensure that smart contracts are crafted with clear, unambiguous coding that aligns with legal standards. This interdisciplinary approach aims to bridge the gap between technology and law, promoting a more cohesive integration of smart contracts within the legal framework. By enhancing legal understanding in the tech industry and vice versa, smarter and more enforceable contracts can emerge, ultimately shaping the future of agreements in a digital world.

The future advancements in smart contract technology will significantly influence various sectors and their operations.

As smart contract technology continues to evolve, it promises to reshape numerous industries by enhancing efficiency, transparency, and security. The integration of emerging technologies such as Artificial Intelligence (AI) and the Internet of Things (IoT) is expected to drive significant advancements in how smart contracts operate, leading to broader applications and improved functionalities.

Emerging Technologies Enhancing Smart Contracts

The fusion of smart contracts with AI and IoT is a game-changer, as it provides innovative solutions that can automate complex processes and enhance data verification methods. Here are some key aspects of this integration:

- AI Integration: AI can enhance decision-making within smart contracts by enabling them to analyze data, learn from patterns, and adjust terms autonomously. For instance, in insurance, AI can process claims faster by cross-referencing data from various sources, leading to quicker payouts.

- IoT Connectivity: IoT devices can trigger smart contracts based on real-time data. For example, in supply chain management, sensors can automatically initiate contract execution upon detecting that goods have arrived at their destination, ensuring seamless operations.

- Predictive Analytics: By leveraging AI, smart contracts can utilize predictive analytics to foresee potential issues in transactions and adjust terms accordingly, which is particularly useful in financial services for risk management.

Integration with Blockchain 2.0 and 3.0 Technologies

The evolution from Blockchain 1.0 to 2.0 and now into 3.0 introduces capabilities that significantly boost the potential of smart contracts. Blockchain 2.0 allows for complex programmability, while Blockchain 3.0 focuses on scalability, interoperability, and usability. This synergy opens new avenues for various sectors:

- Enhanced Scalability: Blockchain 3.0 platforms, such as EOS and Cardano, are designed to handle thousands of transactions per second, thus enabling smart contracts to scale efficiently in high-demand environments, like fintech applications.

- Interoperability: Seamless interaction between different blockchain networks allows smart contracts to operate across various platforms, creating a more integrated ecosystem. This is vital for industries like healthcare where patient data can be securely shared across networks.

- User-friendly Interfaces: Improved interfaces on Blockchain 3.0 platforms make it easier for non-technical users to create and interact with smart contracts, which could democratize their use in everyday transactions.

Potential Challenges in Smart Contract Evolution

Despite the promising advancements, the evolution of smart contracts comes with its own set of challenges. These hurdles could impact their widespread adoption across industries:

- Regulatory Compliance: As smart contracts automate processes, ensuring compliance with existing laws and regulations becomes crucial. Governments may need to update legal frameworks to accommodate this technology, which can be a lengthy process.

- Technological Limitations: The current limitations in blockchain technology, such as energy consumption and transaction speed, can hinder the efficiency of smart contracts. Ongoing research and development are essential to address these problems.

- Security Risks: While smart contracts are designed to be secure, vulnerabilities in their code can lead to exploits. Ensuring robust security measures during the development phase is paramount to prevent potential breaches.

“The integration of smart contracts with advanced technologies will redefine how transactions are conducted, making them more efficient and reliable.”

Final Wrap-Up

In summary, Smart Contracts present a transformative approach to agreements, blending technology with legal frameworks to enhance efficiency and security. As they continue to evolve, the collaboration between technologists and legal experts will be vital in addressing challenges and unlocking new opportunities. The future holds exciting prospects for Smart Contracts, promising to redefine the landscape of contractual obligations in a digital age.

Top FAQs

What are Smart Contracts?

Smart Contracts are self-executing contracts where the terms are directly written into code, automatically executing transactions when conditions are met.

How do Smart Contracts differ from traditional contracts?

Unlike traditional contracts, Smart Contracts automate execution and eliminate intermediaries, enhancing efficiency and reducing costs.

What industries benefit from Smart Contracts?

Industries such as finance, healthcare, and supply chain management are leveraging Smart Contracts for improved operational efficiency and transparency.

What are the common risks associated with Smart Contracts?

Common risks include coding errors, security vulnerabilities, and potential legal ambiguities that may arise during execution.

How can Smart Contracts be secured?

Smart Contracts can be secured through rigorous testing, audits, and employing best coding practices to mitigate vulnerabilities.

What role do audits play in Smart Contracts?

Audits help identify potential security risks and ensure that Smart Contracts are functioning as intended, enhancing overall reliability.