Decentralized Finance, or DeFi, is revolutionizing the way we think about money and financial systems. By leveraging blockchain technology, DeFi eliminates intermediaries, creating a more accessible and efficient financial ecosystem. This new paradigm not only fosters innovation but also empowers individuals to take control of their financial futures.

With transparency and lower costs at its core, decentralized finance is offering services like lending, borrowing, and trading without the traditional barriers that often exclude many from participating in the financial system. As we delve deeper into this fascinating landscape, we will explore how DeFi is reshaping our interactions with money and finance.

Decentralized Finance Overview Explaining the fundamental concepts of decentralized finance

Decentralized finance, often referred to as DeFi, represents a revolutionary shift in how we engage with financial services. Unlike traditional finance, which relies on centralized institutions like banks and payment processors, DeFi leverages blockchain technology to create an open and permissionless financial ecosystem. This approach not only enhances accessibility but also fosters innovation and reduces costs for users.

DeFi differs significantly from traditional financial systems in several key areas. While conventional finance typically involves intermediaries that facilitate transactions and manage assets, DeFi enables users to interact directly with smart contracts on the blockchain. This direct interaction eliminates the need for intermediaries and allows for greater transparency, lower fees, and enhanced user control over assets. Additionally, DeFi platforms operate 24/7, providing continuous access to financial services unlike traditional banking hours.

Role of Blockchain Technology in Enabling Decentralized Finance

Blockchain technology is the backbone of decentralized finance, providing a secure, transparent, and immutable ledger for all transactions. By deploying smart contracts—self-executing contracts with the terms of the agreement directly written into code—DeFi protocols can automate and streamline various financial services. This reduces the risk of human error and fraud, promoting trust among users.

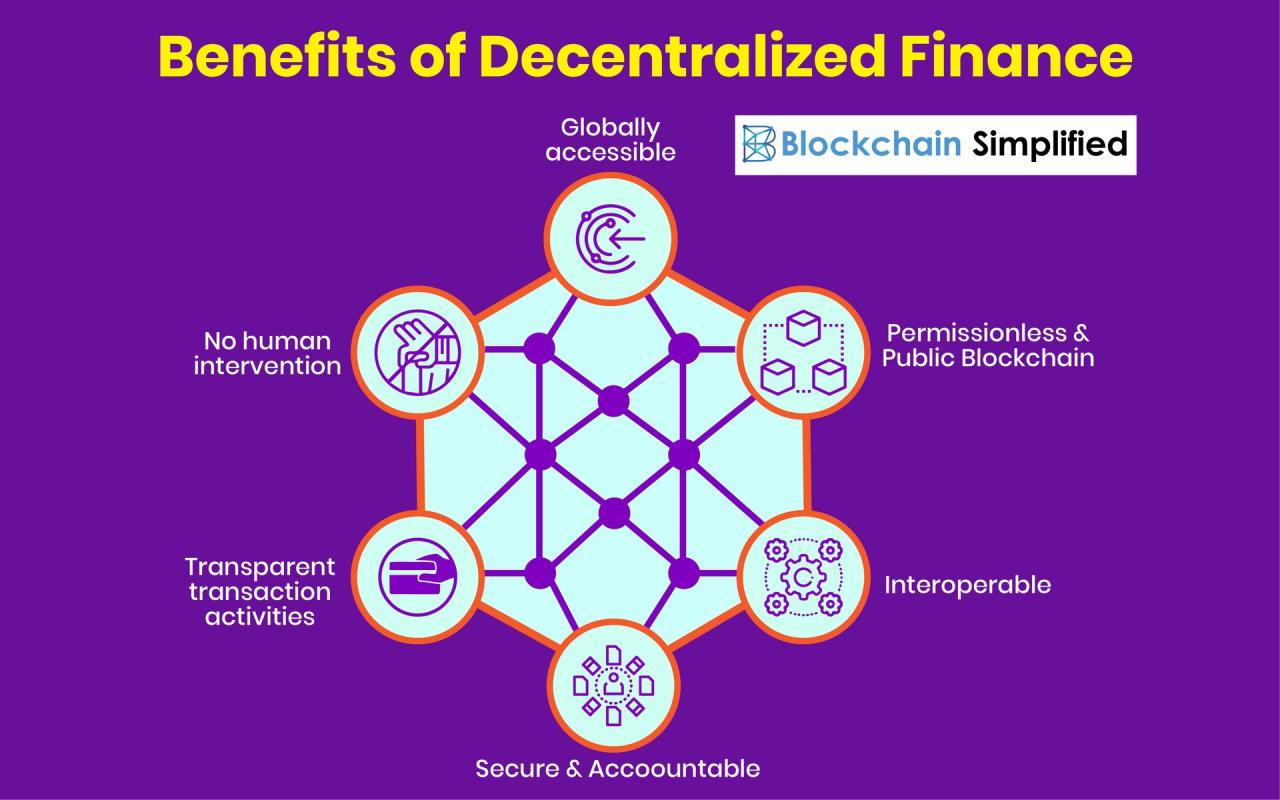

The benefits of blockchain technology in DeFi can be encapsulated as follows:

- Transparency: Transactions on the blockchain are publicly accessible and verifiable, ensuring that users can audit and trust the system without relying on centralized authorities.

- Accessibility: Anyone with an internet connection can access DeFi services, breaking down geographical and socioeconomic barriers that exist in traditional finance.

- Security: Advanced cryptographic techniques secure user data and funds, minimizing the risks associated with hacks and fraud.

- Interoperability: Many DeFi protocols are designed to work together, allowing users to move assets freely across different platforms and applications.

The application of blockchain technology in DeFi leads to the creation of innovative financial products, such as decentralized exchanges (DEXs), lending platforms, and yield farming protocols. For example, platforms like Uniswap allow users to trade tokens directly from their wallets without the need for an intermediary, while lending platforms like Aave enable users to earn interest on their deposits or borrow assets against their crypto holdings.

“Decentralized finance is not just a trend; it’s a paradigm shift in how we conceive and interact with financial systems.”

Advantages of Decentralized Finance Highlighting the key benefits of using decentralized finance platforms

Decentralized Finance (DeFi) is transforming the financial landscape by creating a more open, accessible, and efficient financial ecosystem. By leveraging blockchain technology, DeFi platforms are removing barriers to entry for users, facilitating greater participation in the financial system while promoting inclusivity and transparency.

One of the most significant advantages of DeFi is its ability to enhance accessibility. Unlike traditional financial systems that often require a bank account or credit history, DeFi platforms allow anyone with an internet connection to access a wide range of financial services. This is particularly beneficial for underbanked populations who may lack access to conventional banking services. The elimination of intermediaries reduces costs associated with financial transactions, leading to lower fees for users. For example, platforms like Uniswap and Aave enable users to trade and lend assets directly, often at a fraction of the cost compared to traditional finance.

Financial Inclusion and Accessibility

DeFi plays a crucial role in promoting financial inclusion, especially for those who are underserved by traditional banking infrastructures. It offers opportunities for individuals to participate in the financial system without the stringent requirements often imposed by banks.

- Access to Financial Services: DeFi allows users from various backgrounds to utilize services such as lending, borrowing, and earning interest on their digital assets without requiring extensive documentation.

- Global Reach: With no geographic limitations, individuals in remote areas can access financial services, enabling them to participate in the global economy.

- Empowerment through Ownership: Users maintain control over their assets, facilitating personal financial management and autonomy.

Transparency and Security Features

Transparency and security are at the core of DeFi’s appeal. Blockchain technology ensures that all transactions are recorded on a public ledger, providing real-time visibility and accountability.

- Open Ledger: All transactions are visible and verifiable on the blockchain, reducing the risk of fraud and enhancing trust in the financial system.

- Smart Contracts: Automated smart contracts execute transactions based on predetermined conditions, minimizing the potential for human error and increasing security.

- Decentralization: By removing central authorities, DeFi platforms reduce the risk of single points of failure, enhancing the overall security of financial transactions.

“With decentralized finance, the power shifts from financial institutions to individuals, fostering a more inclusive and secure financial landscape.”

Common Use Cases of Decentralized Finance Identifying the primary applications of decentralized finance in various sectors

Decentralized Finance (DeFi) has emerged as a transformative force in the financial landscape, providing innovative solutions across various sectors. The core principles of DeFi revolve around using blockchain technology to create open, permissionless financial services that operate outside traditional banking systems. By leveraging smart contracts and decentralized networks, DeFi applications offer greater accessibility, transparency, and efficiency.

One of the most compelling aspects of DeFi is its diverse range of use cases. These applications span lending, borrowing, trading, and insurance services, showcasing the potential of blockchain technology to redefine financial interactions. In this context, it’s also essential to explore the role of native tokens and stablecoins, which underpin many DeFi platforms, along with the substantial impact DeFi has on remittances and cross-border transactions.

Lending and Borrowing Services in DeFi

Lending and borrowing are among the foundational services offered in the DeFi ecosystem. Users can lend their cryptocurrencies to others and earn interest without the need for intermediaries. Similarly, borrowers can access loans by providing collateral, usually in the form of cryptocurrencies.

- Aave: A decentralized lending platform that allows users to earn interest on deposits and borrow assets against their collateral. It operates with a wide variety of cryptocurrencies and supports various lending protocols.

- Compound: A popular DeFi protocol that enables users to lend and borrow cryptocurrencies. Interest rates on Compound are algorithmically determined based on supply and demand dynamics.

Trading Services in DeFi

DeFi also revolutionizes trading with decentralized exchanges (DEXs) that allow users to trade cryptocurrencies directly from their wallets. These platforms eliminate the need for custodial intermediaries, offering enhanced security and privacy.

- Uniswap: A leading DEX that uses an automated market maker (AMM) model to facilitate trading without order books, enabling users to swap tokens seamlessly.

- SushiSwap: Originally a fork of Uniswap, SushiSwap offers additional features such as yield farming and liquidity mining, enhancing user engagement and rewards.

Insurance Services in DeFi

The DeFi space has also seen innovative insurance models that protect users against various risks, such as smart contract failures and hacks. These services operate through decentralized protocols, making insurance more accessible and cost-effective.

- Nexus Mutual: A decentralized insurance platform that allows users to pool their funds to provide coverage against smart contract risks, ensuring users are protected from unforeseen losses.

- Etherisc: A project focused on building decentralized insurance applications, Etherisc aims to democratize access to insurance products while reducing operational costs.

Native Tokens and Stablecoins in DeFi

Native tokens and stablecoins play a critical role in the DeFi ecosystem, serving as mediums of exchange, governance tokens, and collateral for loans. Native tokens are often issued by DeFi projects and can provide holders with voting rights or staking rewards.

Stablecoins, on the other hand, are pegged to fiat currencies, offering stability amidst the volatility of cryptocurrencies. They are widely used in DeFi applications for trading, lending, and yield farming.

- DAI: A decentralized stablecoin that is pegged to the US dollar and generated through the MakerDAO protocol, allowing users to access stable assets within the DeFi space.

- USDC: A fiat-backed stablecoin that provides a reliable means of transaction in various DeFi applications, ensuring users can maintain value while engaging in decentralized finance.

Impact of DeFi on Remittances and Cross-Border Transactions

DeFi significantly impacts remittances and cross-border transactions by reducing costs and increasing transaction speeds. Traditional remittance services often involve high fees and delays, while DeFi enables near-instant transfers with minimal fees.

By utilizing blockchain technology and cryptocurrencies, individuals can send money across borders without relying on banks or intermediaries, making it easier for users in developing regions to access financial services.

“Decentralized Finance is redefining the way we think about financial services, providing a more inclusive and efficient alternative to traditional systems.”

Challenges Facing Decentralized Finance Examining the obstacles and risks associated with decentralized finance

Decentralized Finance (DeFi) has emerged as a revolutionary approach to financial transactions, offering a myriad of benefits such as transparency, accessibility, and efficiency. However, along with these advantages, the DeFi landscape is riddled with various challenges and risks that can hinder its growth and adoption. Understanding these obstacles is crucial for developers, investors, and users alike, as they navigate the complex world of decentralized finance.

Common Security Risks

The DeFi ecosystem is particularly susceptible to security vulnerabilities due to its reliance on smart contracts and blockchain technology. The decentralized nature of these platforms means that once a smart contract is deployed, it is often immutable, which can lead to irreparable consequences if vulnerabilities are exploited. Notable risks include:

- Smart Contract Vulnerabilities: Coding errors or unforeseen flaws in smart contracts can lead to significant financial losses. Projects like the DAO hack in 2016, where $60 million was stolen due to a smart contract exploit, underscore the critical importance of thorough audits and testing.

- Hacks and Exploits: DeFi platforms have been prime targets for hackers. In 2021 alone, DeFi platforms suffered losses exceeding $1.3 billion through various hacking incidents. This highlights the need for robust security measures and protocols.

- Phishing Attacks: Users can also fall victim to phishing scams that aim to steal private keys or sensitive information, often leading to the loss of funds. Education on security practices is essential to mitigate these risks.

Regulatory Challenges

As DeFi platforms operate outside traditional financial systems, they often encounter significant regulatory hurdles. Governments worldwide are still grappling with how to regulate cryptocurrencies and DeFi, leading to an uncertain landscape. Key challenges include:

- Compliance Issues: Many DeFi protocols struggle to comply with existing financial regulations, such as anti-money laundering (AML) and know your customer (KYC) requirements. This can result in legal repercussions or shutdowns.

- Jurisdictional Ambiguities: The cross-border nature of DeFi complicates regulatory enforcement. Different countries have varying laws regarding cryptocurrencies, leading to confusion and potential conflicts.

- Potential for Overregulation: Striking a balance between protecting consumers and fostering innovation is critical. Overregulation could stifle growth and drive projects offshore, where regulations are more lenient.

Scalability Issues

Scalability remains a pressing concern for DeFi platforms, impacting user experience and transaction efficiency. As the popularity of DeFi applications grows, the underlying blockchain networks often struggle to handle increased demand. Important factors affecting scalability include:

- Network Congestion: High transaction volumes can lead to slower processing times and increased fees, making DeFi less appealing to users. Ethereum, for instance, has faced significant congestion during peak usage periods, leading to high gas fees.

- Limitations of Current Protocols: Many existing blockchain networks were not designed to accommodate the rapid growth of DeFi, resulting in limitations on transaction throughput and speed.

- Layer 2 Solutions: To address scalability challenges, various projects are developing Layer 2 solutions, such as rollups and sidechains, which can significantly enhance transaction speed and reduce costs without compromising security.

Future Trends in Decentralized Finance Speculating on the potential developments within the decentralized finance landscape

The world of decentralized finance (DeFi) is continuously evolving, driven by innovative technologies and shifting market dynamics. As we look to the future, several key trends are emerging that promise to reshape the DeFi landscape. From layer-2 solutions addressing scalability issues to the growing influence of decentralized autonomous organizations (DAOs), these developments could significantly impact how individuals and institutions engage with finance.

Emerging Technologies and Layer-2 Solutions

Layer-2 solutions have gained traction as a response to the scalability challenges faced by blockchain networks, particularly Ethereum. These solutions enable faster transaction speeds and lower costs, making DeFi more accessible.

- Optimistic Rollups: This technology processes transactions off the main Ethereum chain while still relying on its security. By batching transactions, it significantly reduces fees and increases throughput, which is crucial for DeFi applications.

- ZK-Rollups: Zero-knowledge rollups also process transactions off-chain but use cryptographic proofs to validate transactions on-chain. This enhances privacy and security while maintaining scalability.

- Sidechains: Independent blockchains that run in parallel to the main chain can handle specific DeFi applications. They allow for increased customization and functionality tailored to specific use cases, such as gaming or lending platforms.

The widespread adoption of these layer-2 solutions is likely to enhance user experience in DeFi, leading to greater participation from both retail and institutional investors.

Role of Decentralized Autonomous Organizations (DAOs)

Decentralized autonomous organizations (DAOs) are transforming governance and decision-making processes in finance. These entities operate on smart contracts and allow stakeholders to participate in a transparent, democratic manner.

- Community Governance: DAOs empower users to vote on proposals, allocate funds, and shape protocols. This shift towards community-driven governance can lead to more inclusive financial systems.

- Investment DAOs: These organizations pool resources from members to invest in various projects. By democratizing investment opportunities, they provide access to assets that were previously exclusive to high-net-worth individuals.

- Protocol Development: DAOs can facilitate quicker iterations and adaptations of financial products. By allowing users to propose changes directly, DAOs can respond to market needs more efficiently.

As DAOs continue to grow in influence, they may play a pivotal role in redefining how financial products are developed and governed.

Institutional Adoption of Decentralized Finance

The entry of institutional players into DeFi can significantly impact its growth trajectory. As traditional financial institutions start to recognize the benefits of decentralized systems, we can expect a range of developments.

- Increased Investment: As seen with firms like Grayscale and Galaxy Digital, institutional investment in DeFi projects is rising. This influx of capital can spur innovation and help stabilize the market.

- Regulatory Clarity: With institutional involvement, there is a push for clearer regulations. This can lead to a more structured environment where DeFi can thrive responsibly.

- Hybrid Models: Many institutions are exploring hybrid models that combine traditional finance with decentralized technologies. This could result in products that offer the transparency and efficiency of DeFi while maintaining the trust of regulated environments.

The combination of institutional interest and regulatory clarity can foster a more robust ecosystem, potentially driving the mainstream adoption of decentralized finance.

Integrating Traditional Finance with Decentralized Finance Analyzing the synergy between conventional finance and decentralized finance

The intersection of traditional finance (TradFi) and decentralized finance (DeFi) is generating significant interest and innovation in the financial sector. As digital assets and blockchain technology gain traction, traditional financial institutions are reevaluating their operations to adapt and integrate these new paradigms. This synergy not only enhances the financial landscape but also offers consumers and businesses new opportunities for growth and efficiency.

In the ongoing evolution of financial services, traditional financial institutions are beginning to embrace innovations brought about by decentralized finance. Major banks and financial organizations are exploring ways to integrate blockchain technology into their operations, creating a hybrid model that combines the reliability of traditional finance with the flexibility and transparency of decentralized systems. This integration can be seen in various forms, from adopting stablecoins for transactions to utilizing blockchain for improving settlement times and reducing costs.

Adapting Traditional Financial Institutions to Decentralized Finance Innovations

The adaptation of traditional financial institutions to DeFi innovations is crucial for staying relevant in a rapidly changing market. Several strategies and initiatives highlight this ongoing transformation:

- Many banks are investing in blockchain technology to streamline processes, reduce fraud, and enhance security. For instance, JPMorgan has launched its own digital currency, JPM Coin, to facilitate instant cross-border payments and transactions.

- Financial institutions are forming partnerships with DeFi platforms to offer clients hybrid services that leverage both systems. An example is the collaboration between Goldman Sachs and various DeFi projects to explore potential investment opportunities in digital assets.

- Regulatory compliance is becoming a focal point for traditional institutions as they navigate the complexities of DeFi. By developing frameworks that align with regulations while leveraging DeFi’s benefits, these institutions can provide safer and more compliant services.

The potential advantages of integrating traditional finance with decentralized finance are substantial, creating a more resilient and efficient financial system. These benefits include:

Enhanced transaction speed and lower costs through blockchain technology can significantly improve financial services.

- Increased financial inclusion is achievable as DeFi platforms can provide access to financial services for unbanked populations, thus promoting economic growth.

- By utilizing smart contracts, traditional institutions can automate processes and reduce reliance on intermediaries, which can lead to faster and more transparent transactions.

- Collaboration between TradFi and DeFi can lead to innovative financial products that harness the strengths of both systems, such as tokenized assets that provide liquidity and fractional ownership.

The integration of traditional finance with decentralized finance is reshaping the future of financial services, blending innovation with legacy systems to create a more interconnected and efficient ecosystem. As the financial landscape continues to evolve, the synergy between these two worlds will likely unveil opportunities for enhanced services and experiences for consumers and businesses alike.

Decentralized Finance Security Practices Outlining best practices for ensuring security in decentralized finance operations

In the rapidly evolving landscape of decentralized finance (DeFi), security is paramount. As users flock to these platforms for their innovative financial solutions, the potential risks also escalate. Implementing robust security practices is essential to protect investments and maintain user trust. This section Artikels critical best practices to enhance security across DeFi operations, ensuring that both developers and users can navigate this space safely.

Importance of Audits and Code Reviews for Decentralized Finance Projects

Conducting thorough audits and code reviews is vital for DeFi projects to identify vulnerabilities and ensure smart contracts function as intended. Engaging third-party auditors can provide an objective assessment, highlighting areas that may require improvement or adjustment. Regular audits can prevent significant financial losses and protect user assets.

- Smart Contract Audits: Independent audits of smart contracts can reveal potential exploit vectors before they are deployed, minimizing risk.

- Continuous Code Review: Ongoing reviews during development can catch bugs or security flaws early in the software life cycle, reducing the chances of exploits.

- Community Involvement: Encouraging community members to contribute to code reviews can enhance security through diverse perspectives and expertise.

Methods for Users to Safeguard Their Investments in Decentralized Finance Platforms

While developers ensure platform security, users must take proactive steps to protect their investments. Awareness of best practices can significantly reduce the risk of loss due to hacks or scams.

- Use Hardware Wallets: Storing cryptocurrencies in hardware wallets provides an additional layer of security against online threats.

- Enable Two-Factor Authentication (2FA): Implementing 2FA on accounts adds another barrier for unauthorized access, securing personal information and assets.

- Research Projects: Users should conduct thorough research on DeFi projects, including their audits, team background, and community reputation before investing.

Role of Community Governance in Enhancing Security within Decentralized Finance

Community governance plays a pivotal role in maintaining security within DeFi ecosystems. By empowering token holders to participate in decision-making, projects can foster a culture of collaboration and transparency.

- Decentralized Decision-Making: Community governance allows stakeholders to vote on crucial security measures, ensuring the collective interests are prioritized.

- Bug Bounty Programs: Communities can establish bounty programs to incentivize developers to report vulnerabilities, enhancing overall platform security.

- Transparency in Protocol Changes: Open discussions regarding updates or changes to the protocol help build trust and ensure that security implications are adequately considered.

Community and Ecosystem in Decentralized Finance Understanding the role of community in driving decentralized finance initiatives

The decentralized finance (DeFi) ecosystem thrives on the active engagement of its community. This engagement not only fosters innovation but also shapes the protocols that emerge from collective efforts. Unlike traditional finance, where decisions often stem from central authorities, DeFi relies heavily on community input, collaboration, and support to create robust financial products and services.

Community engagement profoundly influences the development of decentralized finance protocols. Developers and project founders often turn to their communities for feedback, validation, and even funding. The more a community is involved, the more likely the protocol will adapt to meet the needs of its users. This collaborative spirit helps ensure that DeFi projects remain relevant and user-friendly, creating an ecosystem that evolves organically.

Influence of Community Engagement on Protocol Development

Active community participation can significantly enhance the development of DeFi protocols. Community members contribute ideas, identify bugs, and suggest enhancements, allowing for a more user-centric approach in development. The relationship between developers and the community fosters a sense of ownership, as users feel invested in the success of the projects they support.

Key aspects of community engagement in DeFi include:

- Feedback loops: Continuous interaction between users and developers leads to the rapid identification of issues and potential enhancements.

- Funding opportunities: Community-driven fundraising efforts, like Initial DEX Offerings (IDOs) or community grants, help projects secure necessary resources to grow.

- Governance participation: Token holders can vote on important decisions, ensuring that the protocol aligns with community interests.

The evolution of successful decentralized finance projects often hinges on their ability to cultivate a supportive community. Projects like Uniswap and Aave serve as prime examples of how community backing can drive success.

Examples of Successful DeFi Projects Driven by Community Support

Several DeFi projects have thrived due to robust community engagement, showcasing the power of collective effort:

- Uniswap: This decentralized exchange has become a staple in the DeFi space, largely due to its community-driven governance model and active user base, which participates in decision-making and development processes.

- Aave: With a focus on lending and borrowing, Aave has attracted a dedicated community that contributes to its governance and continuously provides feedback to improve the platform.

- Yearn Finance: The growth of Yearn Finance is tied closely to its community, which actively participates in yield optimization strategies and helps shape the direction of the project.

These examples underscore the importance of community in not only providing support but also driving innovation within the DeFi landscape.

Collaboration Among Developers, Users, and Investors

Collaboration in the DeFi space is integral to its growth and sustainability. The intersection of developers, users, and investors creates a dynamic ecosystem where each group plays a crucial role in shaping the future of decentralized finance.

The importance of collaboration manifests in several ways:

- Shared knowledge: Developers and users often exchange insights that can lead to improved platform features and security.

- Investor involvement: Investors bring not only capital but also strategic insights that can help guide project trajectories.

- Cross-project partnerships: Collaboration between different DeFi projects can lead to enhanced interoperability, creating a more robust ecosystem.

In summary, the decentralized finance ecosystem is a vibrant tapestry woven together by the engagement of its community members. The active participation of developers, users, and investors ensures that DeFi continues to innovate and adapt, ultimately leading to a financial landscape that is more inclusive and accessible for everyone.

Conclusive Thoughts

In summary, decentralized finance is not just a trend; it is a significant shift in how we conceptualize and engage with finance. As the landscape continues to evolve, we can expect exciting developments that enhance accessibility, security, and collaboration. Embracing these changes will be essential for anyone looking to navigate the future of finance effectively.

FAQs

What is the main purpose of Decentralized Finance?

The main purpose of Decentralized Finance is to provide an open and permissionless financial system that allows anyone to participate in financial services without relying on traditional intermediaries.

How does Decentralized Finance ensure security?

Decentralized Finance ensures security through smart contracts that are audited, community governance, and best practices in code review, minimizing the risk of vulnerabilities.

Can anyone use Decentralized Finance platforms?

Yes, anyone with internet access and a digital wallet can use Decentralized Finance platforms, making it accessible to people worldwide, including those who are underbanked.

What are stablecoins, and why are they important in DeFi?

Stablecoins are cryptocurrencies pegged to stable assets like the US dollar, and they are important in DeFi as they reduce volatility, making transactions and lending more predictable.

Are there any regulatory concerns with Decentralized Finance?

Yes, regulatory concerns exist as governments and financial institutions are still figuring out how to approach DeFi, leading to potential challenges in compliance and legal frameworks.